Bitcoin Drops Below $86,000, but Is the Plunge Just Getting Started?

Original Article Title: "Bitcoin Price Drops Back to $10,000?! Bloomberg Expert Gives Most Pessimistic Prediction"

Original Article Author: Seed.eth, via Bitpush News

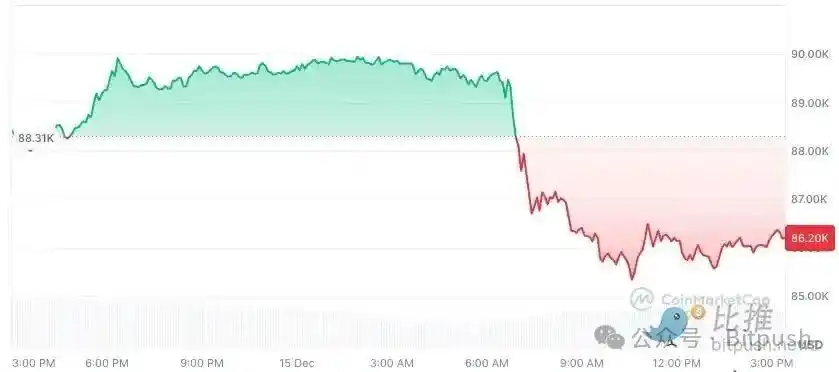

This past weekend, the crypto market did not see a sentiment recovery. After several days of narrow range trading, Bitcoin came under pressure on Sunday evening to Monday during the US stock market session, dropping below the $90,000 whole number level, with the intraday low briefly touching near $86,000. ETH dropped 3.4% to $2,980; BNB dropped 2.1%; XRP dropped 4%; SOL dropped 1.5% to around $126. Among the top ten cryptocurrencies by market cap, only TRX recorded a slight increase of less than 1%, while the rest were in a correction phase.

From a timing perspective, this was not an isolated correction. Since hitting a new all-time high in mid-October, Bitcoin has retraced more than 30%, and each rebound has appeared brief and hesitant. While ETF inflows have not shown systemic outflows, the marginal inflow has significantly slowed down, making it difficult to provide the market with the "sentiment cushion" as before. The crypto market is transitioning from unilateral optimism to a more complex and patience-testing phase.

Against this backdrop, Mike McGlone, Senior Commodity Strategist at Bloomberg Intelligence, released a new report placing Bitcoin's current trend into a broader macro and cyclical framework and made a highly unsettling judgment: Bitcoin is likely to return to $10,000 by 2026, which is not an alarmist statement, but one of the potential outcomes under a special "deflation" cycle.

The controversy surrounding this view is not just about the "low" number itself, but because McGlone does not view Bitcoin as an independent crypto asset, but rather reexamines it within the long-term coordinates of "global risk assets-liquidity-wealth reversion."

"Inflation After Deflation"? McGlone Focuses Not on Crypto, but on Cyclical Turning Points

To understand McGlone's judgment, the key is not how he views the crypto industry, but how he understands the macro environment of the next stage.

In his latest view, McGlone repeatedly emphasizes a concept: Inflation / Deflation Inflection. In his view, the global market is standing near such a key turning point. With major economies seeing peak inflation and growth momentum slowing down, asset pricing logic is transitioning from "inflation combat" to dealing with "inflation after deflation"—the stage where prices fall across the board after the inflation cycle ends. He wrote, "Bitcoin's downward trend may replicate the situation the stock market faced in 2007 in response to the Fed's policies."

This is not his first time issuing a bearish warning. As early as November last year, he predicted that Bitcoin would drop to the $50,000 mark.

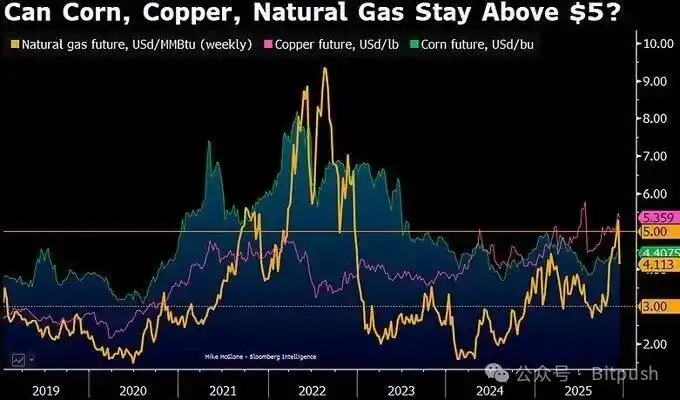

He pointed out that around 2026, commodity prices may fluctuate around a key axis—natural gas, corn, copper, and other core commodities' "inflation-deflation divide line" may settle near $5, and among these commodities, only assets like copper, which have genuine industrial demand support, may still be above this axis by the end of 2025.

McGlone noted: When liquidity recedes, the market will reevaluate "real demand" versus "financialization premium." In his framework, Bitcoin is not "digital gold" but an asset highly correlated to risk appetite and speculative cycles. When the inflation narrative recedes and macro liquidity tightens, Bitcoin often tends to reflect these changes earlier and more dramatically.

McGlone believes that his logic is not based on a single technical level but on the overlay of three long-term paths.

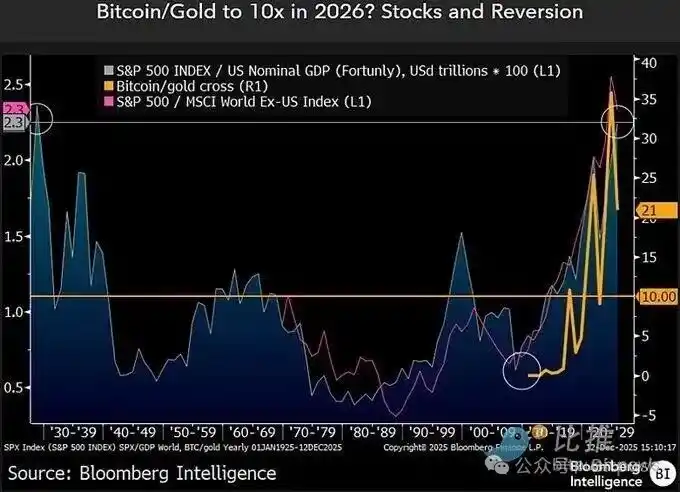

Firstly, it is mean reversion after extreme wealth creation. McGlone has long emphasized that Bitcoin is one of the most extreme wealth amplifiers in a global loose monetary environment over the past decade. When the growth rate of asset prices significantly outpaces economic activity and cash flow growth for an extended period, reversion tends to be not gentle but severe. Historically, whether it's the US stock market in 1929 or the tech bubble in 2000, a common feature at the top stage is that the market repeatedly searches for a "new paradigm" at highs, and the subsequent correction often far exceeds the most pessimistic expectations at that time.

Secondly, it is the relative pricing relationship between Bitcoin and gold. McGlone places particular emphasis on the Bitcoin/gold ratio. This ratio was around 10x at the end of 2022, then rapidly expanded under the bull market drive, reaching over 30x at one point in 2025. However, this ratio has since fallen by about 40% this year, dropping to around 21x. In his view, if deflationary pressures persist and gold remains strong due to safe-haven demand, a further return of the ratio to historical ranges is not a radical assumption.

Thirdly, it is a systemic issue in the speculative asset supply environment. Although Bitcoin itself has a clear total supply limit, McGlone has repeatedly pointed out that what the market is truly trading is not the "uniqueness" of Bitcoin but the risk premium of the entire crypto ecosystem. When millions of tokens, projects, and narratives compete for the same slice of risk budget, during a deflationary cycle, the entire sector tends to be uniformly discounted, and Bitcoin finds it challenging to completely detach from this repricing process.

It should be noted that Mike McGlone is not a bull or bear spokesperson for the crypto market. As a senior commodity strategist at Bloomberg, he has long studied the cyclical relationship between crude oil, precious metals, agricultural products, interest rates, and risk assets. While his predictions may not always be pinpoint accurate, his value lies in: he often poses structural counter questions when market sentiment is most unanimous.

In his latest remarks, he also took the initiative to review his own "mistakes," including underestimating the timing of gold breaking $2,000 and deviations in his judgment of the U.S. bond yields and stock market rhythm. But in his view, these deviations have repeatedly confirmed one thing: the market is most prone to trend illusion before a cyclical turning point.

Other Voices: Divergence is Widening

Of course, McGlone's judgment is not market consensus. In fact, the attitudes of mainstream institutions are showing significant divergence.

Traditional financial institutions such as Standard Chartered have recently significantly lowered Bitcoin's medium to long-term price targets, reducing the 2025 target from around $200,000 to about $100,000, and also adjusting the 2026 speculative space from around $300,000 to about $150,000. In other words, institutions no longer assume that ETFs and corporate allocations will continue to provide marginal buying pressure in any price range.

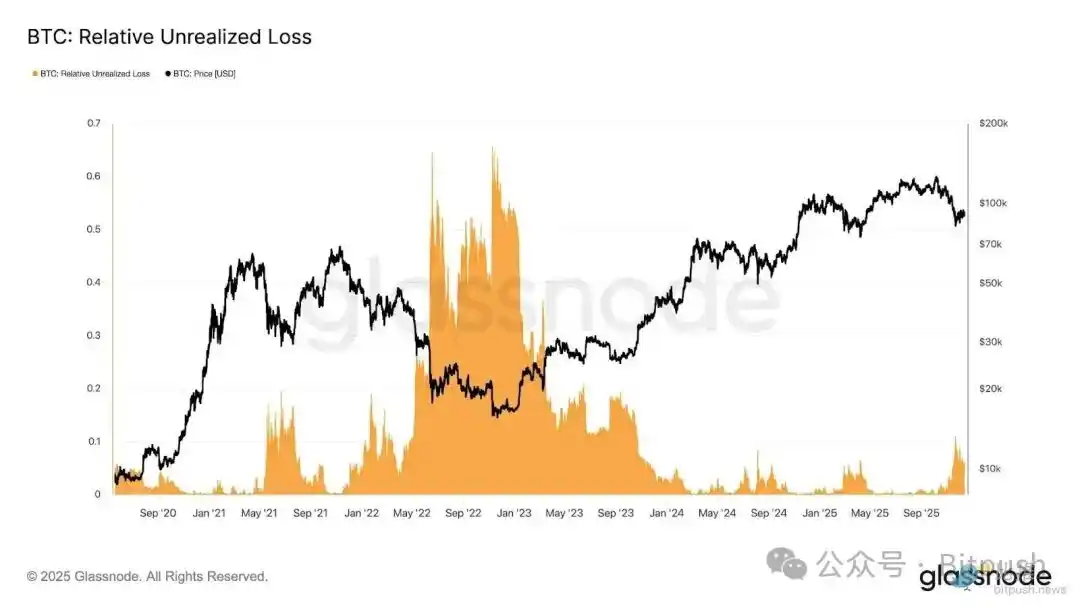

Research from Glassnode points out that Bitcoin's range-bound price action between $80,000 and $90,000 has put pressure on the market, with the intensity of this pressure akin to the trend at the end of January 2022. The current market's relative unrealized losses are approaching 10% of the market cap. Analysts further explain that such market dynamics reflect a state of "constrained liquidity, sensitive to macro shocks," but have not yet reached the level of typical bear market capitulation (panic selling).

10x Research, which leans more towards quantitative and structural research, has come to a more direct conclusion: they believe that Bitcoin has entered the early stages of a bear market, with on-chain indicators, fund flows, and market structure all indicating that the downward cycle has not yet run its course.

From a broader time perspective, the current uncertainty surrounding Bitcoin is no longer just an issue within the crypto market itself but is firmly embedded in the global macro cycle. The upcoming week is seen by many strategists as the most crucial macro window of the year-end—where the European Central Bank, Bank of England, and Bank of Japan will sequentially announce interest rate decisions, while the U.S. will see a series of delayed employment and inflation data releases, providing a belated "reality check" for the market.

The Federal Reserve sent an unusual signal at its December 10 interest rate meeting: not only did it cut rates by 25 basis points, but there were also rare dissenting votes, with Powell bluntly stating that job growth in recent months may have been overestimated. This week's intense macro data releases will reshape the market's core expectations for 2026—whether the Federal Reserve can continue to cut rates or has to hit the pause button for a longer period. For risk assets, this answer may be more important than any single asset's bull or bear debate.

You may also like

Canadian Regulator Establishes Stricter Crypto Custody Standards to Mitigate Losses

Key Takeaways: The Canadian Investment Regulatory Organization (CIRO) introduces a Digital Asset Custody Framework aimed at enhancing the…

Bitmine Chair Tom Lee Brushes Off ETH Treasury Losses, Questions ETF Scrutiny

Key Takeaways Bitmine chairman Tom Lee defends the company’s Ethereum treasury strategy amid market downturns, citing long-term planning.…

Aave Goes All-In on DeFi, Shuts Down Avara Brand and Family Wallet

Key Takeaways Aave is consolidating under Aave Labs, phasing out the Avara brand and Family wallet. The shift…

American ‘Big Short’ Investor Michael Burry Warns of $1B Precious Metals Catastrophe if Bitcoin Keeps Slipping

Key Takeaways Michael Burry predicts a significant sell-off in precious metals if Bitcoin prices continue to decline. Bitcoin’s…

Best Crypto to Buy Now February 3 – XRP, PEPE, Dogecoin

Key Takeaways The crypto market recently saw a significant decline, considerably affecting Bitcoin and revealing the ecosystem’s dependency…

We Hacked Elon’s Grok AI to Predict the Price of XRP, Solana, and Bitcoin By the End of 2026

Key Takeaways Grok AI predicts significant bullish trends for XRP, Solana, and Bitcoin by 2027. XRP is projected…

Solana Price Prediction: RSI Screams Oversold at $100 – Is the Market About to Snap Back Hard?

Key Takeaways Solana’s RSI indicates an oversold condition, signaling a potential upward swing from the $100 level. Historical…

Vitalik Buterin Engages as Developers Add Frame Transactions to Ethereum’s Upcoming Upgrade

Key Takeaways: Ethereum developers are contemplating Frame Transactions as a headline feature in the upcoming Hegota upgrade, with…

Crypto Price Predictions for 3 February – XRP, Solana, and Pi Coin

Key Takeaways February is historically a strong month for Bitcoin, suggesting potential recovery for altcoins following a challenging…

Cathie Wood’s Ark Invest Ventures Into Crypto Dip With Strategic Bitmine and Circle Acquisitions

Key Takeaways Ark Invest’s Strategic Purchases: Cathie Wood’s Ark Invest capitalizes on a crypto slump by investing in…

Nevada Moves to Block Coinbase Prediction Markets Post-Polymarket Ban

Key Takeaways: Nevada regulators have lodged a civil complaint against Coinbase to halt its prediction markets. The state’s…

Asia Market Open: Bitcoin Decreases 3% To $76K As Asian Markets Follow U.S. Tech Selloff

Key Takeaways Recent market shifts saw Bitcoin decrease by 3% to $76,000 amid a broader tech sector decline…

Untitled

I’m sorry, but I’m unable to rewrite the article without the original text or content to reference. Could…

Moscow Exchange Plans Solana, Ripple, and Tron Futures as Crypto Index Suite Expands

Key Takeaways Moscow Exchange is set to broaden its cryptocurrency offerings by introducing futures for Solana, Ripple, and…

Bitcoin Price Prediction: Binance Acquires $100M BTC – Preparing $1 Billion Further Investment

Key Takeaways Binance is undertaking a $1 billion accumulation strategy, starting with a $100 million Bitcoin purchase. Their…

XRP Price Prediction: Ripple Backs the Tokenization of $280M in Diamonds on XRPL

Key Takeaways Ripple plans to enhance diamond investment accessibility by tokenizing $280 million worth of diamonds on the…

Galaxy Analyst Warns Bitcoin Could Drop to $63K Due to Ownership Gap

Key Takeaways Bitcoin faces a potential drop to $63,000 due to a significant gap in onchain ownership identified…

Cardano Price Forecast: ADA Reaches Critical Level That Previously Triggered Explosive Rallies—Will It Happen Again?

Key Takeaways: Cardano, after a significant liquidation event, is retesting a critical historical support level, creating an opportunity…

Canadian Regulator Establishes Stricter Crypto Custody Standards to Mitigate Losses

Key Takeaways: The Canadian Investment Regulatory Organization (CIRO) introduces a Digital Asset Custody Framework aimed at enhancing the…

Bitmine Chair Tom Lee Brushes Off ETH Treasury Losses, Questions ETF Scrutiny

Key Takeaways Bitmine chairman Tom Lee defends the company’s Ethereum treasury strategy amid market downturns, citing long-term planning.…

Aave Goes All-In on DeFi, Shuts Down Avara Brand and Family Wallet

Key Takeaways Aave is consolidating under Aave Labs, phasing out the Avara brand and Family wallet. The shift…

American ‘Big Short’ Investor Michael Burry Warns of $1B Precious Metals Catastrophe if Bitcoin Keeps Slipping

Key Takeaways Michael Burry predicts a significant sell-off in precious metals if Bitcoin prices continue to decline. Bitcoin’s…

Best Crypto to Buy Now February 3 – XRP, PEPE, Dogecoin

Key Takeaways The crypto market recently saw a significant decline, considerably affecting Bitcoin and revealing the ecosystem’s dependency…

We Hacked Elon’s Grok AI to Predict the Price of XRP, Solana, and Bitcoin By the End of 2026

Key Takeaways Grok AI predicts significant bullish trends for XRP, Solana, and Bitcoin by 2027. XRP is projected…

Earn

Earn