How Atlas is Pioneering a New Era of Innovation and Capital Efficiency for Grvt and its Users

We have seen many posts explaining what the ZKsync Atlas upgrade brings.

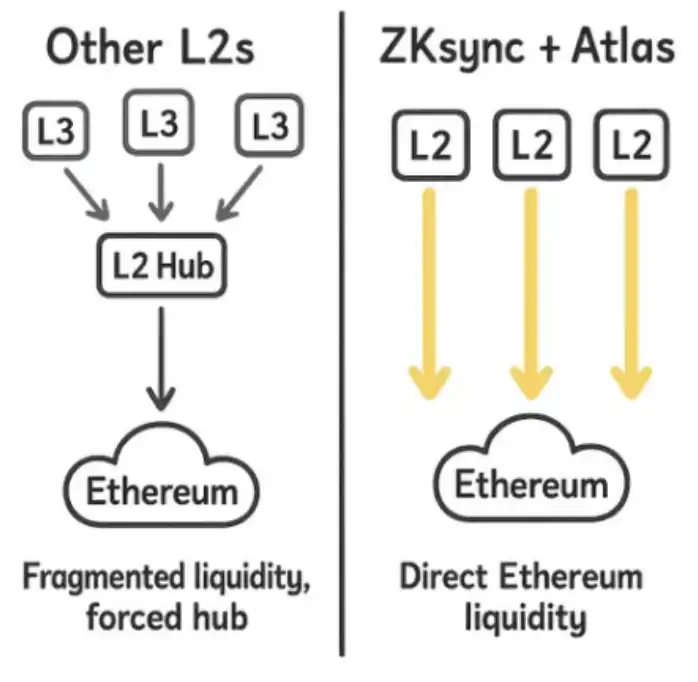

As ZKsync founder Alex put it, the Atlas upgrade "for the first time allows L2 to rely directly on Ethereum as a real-time liquidity hub," which is not only a technical upgrade, but also a reshaping of the ecosystem.

Today, we will focus on the potential new innovations that Grvt may introduce in the future, as well as the new functionalities users can achieve on Grvt through Atlas, as Grvt becomes a core dApp for expanding Ethereum liquidity and market layers in an immutable manner.

As the largest ZKsync-driven dApp, Grvt achieves composability with the Ethereum mainnet through Atlas, coupled with its liquidity and immutability, it is believed that Grvt and its users will benefit most in terms of capital efficiency. The ability to interoperate and be composable with the most popular DeFi dApps on the Ethereum mainnet will open up many possibilities for Grvt and ETH mainnet users to maximize their capital potential. Here are specific ways:

(1) Lending Protocol: Maximize your balance on Grvt through Aave or Euler

With a balance on Grvt, you can directly access borrowing from deep liquidity sources on the Ethereum mainnet through Aave or Euler (TVL of 298.8 billion and 16 billion, respectively), and use the funds for trading and earning yield on Grvt, or invest in Grvt strategies.

(2) Spot DEX: Through Atlas, Grvt users can maximize the utility of their LP position

Users can use LP tokens from Ethereum mainnet's Uniswap or other spot DEXs as collateral for perpetual contract trading, increasing the returns on their LP position. Grvt strategists can also integrate LP positions from spot DEXs into strategies previously limited to perpetual contracts, as a means of diversification. The simplest way is for users to access liquidity from any spot DEX on the Ethereum mainnet through Grvt for token swaps.

(3) LRT and LST Protocols: Enhance the value of your LRT and LST

Through Atlas, traders on Grvt can utilize LRT and LST from protocols such as Eigencloud, Lido, Rocketpool, among others, not only to earn staking rewards but also to use them as margin to open perpetual contract positions, while also enjoying Grvt's native rewards (if still available). This means triple rewards: staking rewards + Grvt native rewards + perpetual trading profits.

Additionally, Grvt strategists can include LRT and LST in their portfolios as a "risk-free" source of income, helping users achieve income diversification while avoiding impermanent loss and high-risk trading.

(4) Yield Protocol: Make Your Pendle Position More Flexible

Similar to LRT and LST, Grvt users can use Pendle's PT (Zero Coupon Bond-like yield-bearing token) as margin to open perpetual positions, achieving triple rewards: (i) Stable yield from PT, (ii) Grvt's native rewards (approximately 10%), (iii) Trading profits.

Grvt strategists can also incorporate Pendle's PT and YT into their strategies to explore more creative sources of income, even achieving high risk-adjusted returns through YT without relying on external infrastructure providers such as Gauntlet or Morpho.

(5) Stablecoin and RWA Protocol: Maple

Taking the example of Maple, an RWA protocol on the Ethereum mainnet, it offers yield-bearing stablecoins based on overcollateralized loans. Users can mint SyrupUSDC on Grvt to: (i) earn passive income on Grvt, (ii) use SyrupUSDC as collateral for perpetual positions while earning returns, (iii) further enhance capital efficiency.

Grvt strategists can also utilize stablecoins from diversified income sources to hedge with stablecoins during "liquidation" while still providing returns to users.

These are just some examples of how ZKsync-powered Grvt becomes an extension of Ethereum's immutability, opening up more product, strategy, and innovation possibilities through increased capital efficiency and liquidity. I am very excited about the breakthrough innovation that Grvt brings, full of anticipation for the potential of Atlas, and I look forward to exploring endless possibilities post-launch!

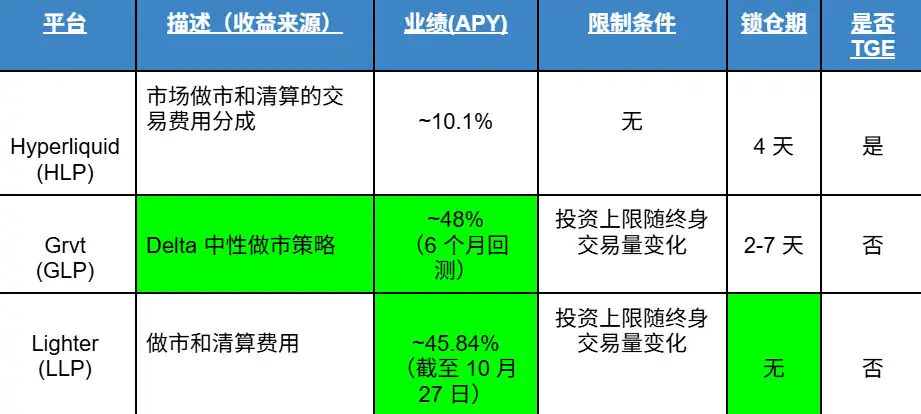

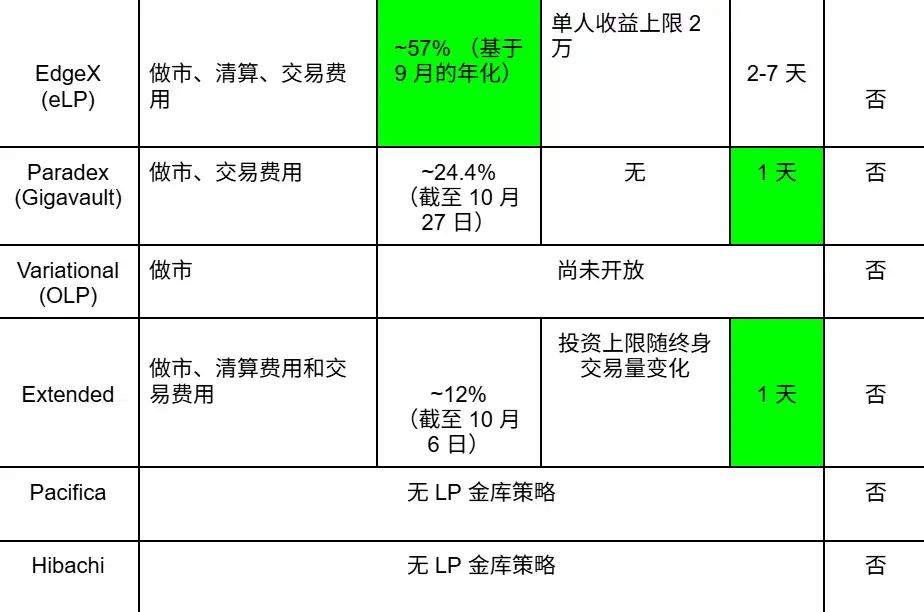

Furthermore, Grvt has just launched its native protocol treasury GLP, which has already surpassed $1.5 million in assets under management in less than 24 hours. Below is a table summarizing key perpetual contract DEXs and their "native" LP treasury strategies.

This article is a contribution and does not represent the views of BlockBeats.

You may also like

February 10th Key Market Information Gap, A Must-See! | Alpha Morning Report

About ERC-8004: Everything You Need to Know

ai.com's Debut Flop: After $70 Million Transaction, Did It Get a '504' Timeout?

FedNow versus The Clearing House: Who Will Win the Fed Payments Fray?

Recovering $70,000 in Lost Funds: The "Fragile Logic" Behind Bitcoin's Rebound

Mr. Beast acquires Step, Farcaster Founder Joins Tempo, what are the international crypto circles talking about today?

February 9th Market Key Intelligence, How Much Did You Miss?

After being questioned by Vitalik, L2s are collectively saying goodbye to the "cheap" era

WEEX AI Trading Hackathon Paris Workshop Reveals: How Retail Crypto Traders Can Outperform Hedge Funds

Witness how WEEX's Paris AI Trading Hackathon revealed AI's edge over human traders. Explore key strategies, live competition results & how to build your own AI trading bot.

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

USOR vs Oil ETFs: Understanding Why the ‘Oil Reserve’ Token Doesn’t Track Crude Prices

Key Takeaways The U.S. Oil Reserve (USOR) token has become noteworthy for its claims, yet it does not…

Trend Research Reduces Ether Holdings After Major Market Turbulence

Key Takeaways: Trend Research has significantly cut down its Ether holdings, moving over 404,000 ETH to exchanges recently.…

Investors Channel $258M into Crypto Startups Despite $2 Trillion Market Sell-Off

Key Takeaways: Investors pumped approximately $258 million into crypto startups in early February, highlighting continued support for blockchain-related…

NBA Star Giannis Antetokounmpo Becomes Shareholder in Prediction Market Kalshi

Key Takeaways: Giannis Antetokounmpo, the NBA’s two-time MVP, invests in the prediction market platform Kalshi as a shareholder.…

Arizona Home Invasion Targets $66 Million in Cryptocurrency: Two Teens Charged

Key Takeaways Two teenagers from California face serious felony charges for allegedly attempting to steal $66 million in…

El Salvador’s Bukele Approval Reaches Record 91.9% Despite Limited Bitcoin Use

Key Takeaways: El Salvador President Nayib Bukele enjoys a record high approval rating of 91.9% from his populace,…