Pendle: Low-Key, Yet DeFi Dominance

After another rollercoaster ride in the crypto market, people have become cautious or even pessimistic about the future. Many MEME coins and projects where "concept outweighs substance" have fallen, prompting the market to rethink fundamental value.

This process is akin to the self-healing of soil after a forest fire, where impatience and speculation are burned away, and projects truly rooted in underlying financial logic and servicing long-term needs garner attention. Pendle, emerging as a DeFi dark horse after the previous bull market's collapse, can be said to have single-handedly pioneered the crypto yield frontier. Pendle has recently achieved an important step in its 2025 Citadels strategy—announcing a partnership with the quantitative fund Fasanara Digital, actively bringing traditional capital into the industry.

The Undisputed King of Yield Trading

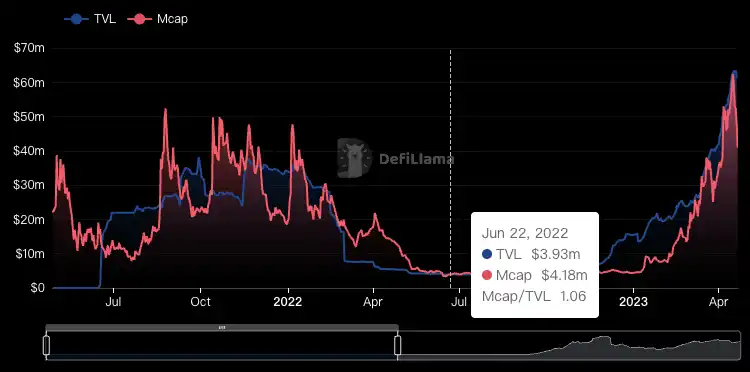

Since its launch in mid-2021, formerly known as Benchmark, Pendle propelled its TVL to nearly $40 million in the glow of DeFi Summer. Subsequently, amidst the long bear market and the fragmentation of DeFi Lego, its TVL also dropped to $4 million. During the same period, more well-known projects announced halts, signaling a falsification of the DeFi yield track.

In hindsight, for Pendle, all the TVL fluctuations in the early days were but imperceptible ripples.

Just as NVIDIA completed a triple jump relying on gaming, mining, and AI, the unfaltering Pendle team, with a profound understanding of the traditional market and an ultimate insight into the crypto market, consecutively hit the Ethereum PoS transition-driven LSD craze and the current hot yield stablecoin track. Just like how Uniswap defined DeFi trading and Aave defined DeFi lending, Pendle has become the industry standard for DeFi yield trading and one of the few DeFi stars in this bull run.

Moreover, in the DeFillama yield track, Pendle once held over half of the TVL, maintaining absolute dominance that other DeFi protocols could not reach.

Not only does Pendle boast a massive TVL, but the protocol's robustness and security are also top-notch in the industry. Since the Pendle protocol settles expired PT and YT, its TVL experiences severe fluctuations on specific dates. However, even so, Pendle has maintained smooth operation and high-value lockups. For example, in June 2024, Pendle settled billions worth of expired positions within a few days. Such short-term liquidity shocks would pose significant risks to many DeFi protocols or even some public chains, but with meticulous smart contract design, Pendle managed to smoothly handle such a massive fund movement in a very short time. Furthermore, in today's market environment, through integration with various protocols, Pendle's TVL can still exceed $5 billion in 2025, demonstrating that the attracted funds and user base are not chasing short-term trends but have a deep conviction in the project's underlying logic and long-term value.

In terms of protocol trading volume, Pendle's average daily transaction volume soared from $1.1 million in 2023 to $96.4 million in 2024, nearly a 100-fold increase. Furthermore, trust in Pendle has significantly increased, with holdings of over $100 million PT becoming commonplace.

Not only is this reflected in the data, but there are also many "crypto whales" in the community who, thanks to the services provided by Pendle, have weathered multiple rounds of market volatility, locked in their yields, and even smartly gained excess returns through YT. Pendle has become the most powerful and indispensable weapon for these DeFi whales and smart money. In addition to Pendle Intern's updates, there are also some "wealth myths" widely circulated in the community. Take Ethena Guagua, for example, who obtained excess returns through operations such as shorting the base currency by buying YT and selling YT to lock in yields.

Source: Guagua

Pendle's "Yield Puzzle"

This article does not delve into the Pendle mechanism in detail. In simple terms, Pendle tokenizes the future income of interest-bearing assets (PT) into Yield Tokens (YT), making them tradable, with PT responsible for fixed income and YT representing income trading. For example, you can think of Pendle as a machine that "splices" your crypto assets in time: it divides your assets into "Principal Tokens (PT)" and "Yield Tokens (YT)." PT is like the "frozen part" of your existing funds, while YT is the "future bonus" that generates interest later on.

If a user holds PT until maturity, they can lock in the principal and no longer bear income fluctuations, as YT treats income as a separate underlying, allowing more users to speculate, hedge, arbitrage, and earn points. By freely trading PT and YT on the market, users can both lock in current value and hedge or strive for potential gains, thereby gaining more strategic choices and opportunities in the DeFi world.

While revenue trading is not common in the crypto industry, with a penetration rate of only about 3%, in the traditional financial sector, whether in bond or interest rate swap transactions, the scale is very large, serving as one of the cornerstones of the global financial system, with the interest rate market size exceeding $600 trillion. By 2024, the nominal principal amount of the Chinese Yuan interest rate swap market reached 360 trillion Yuan, and the USD interest rate market also achieved a record trading volume in 2024, with a nominal transaction amount of $264 trillion. It can be said that in traditional finance, revenue trading is crucial to the development of the financial market.

In comparison, although Pendle has achieved significant growth and has become one of the blue-chip projects in the crypto market, there is still a significant gap compared to the overall size of the traditional financial market. This means that the interest rate derivative track where Pendle is positioned still has tremendous growth potential.

On one hand, Pendle has become a cornerstone in the DeFi revenue trading field; on the other hand, the demand from traditional financial institutions for on-chain finance is rapidly increasing. According to Paradigm's "TradFi Tomorrow" report released on March 18, two-thirds of TradFi institutions have entered DeFi. This allows projects like Pendle, which naturally have the ability to connect DeFi and TradFi, to play an important role in the future revenue trading market by bridging liquidity between both sides and connecting the two markets.

Taking It to the Next Level

Focusing on the present, Pendle's recent progress has also been rapid. Just listing a few recent activities and partnerships, there has been integration with the Sonic Chain—a well-known financial chain with a strong DeFi background, collaboration with the popular BNB Chain project, ListaDAO and Astherus both integrating with Pendle to allow users to obtain Launchpool project tokens at a lower cost. DeFi and yield farming are also fundamental to Pendle V2, and in addition, Pendle's three main pillars are Boros and Citadels.

According to the official statement, the term Boros comes from Greek and means "to devour," symbolizing Pendle's aggressive growth strategy aimed at capturing and absorbing various forms of revenue. Boros introduces margin trading functionality, allowing users to trade various revenue assets with higher capital efficiency, including on-chain and off-chain yield. This means that users can leverage trading to amplify revenue exposure and potentially achieve higher returns.

In addition, Boros also incorporates funding rates into the tradable scope, filling the market's lack of large-scale hedging tools for funding rates. For example, traders can more accurately trade funding rates, have more strategy choices, such as simultaneously longing SOL funding rate and shorting ETH funding rate to capture the spread.

Another pillar, Citadels, aims to expand Pendle to non-EVM ecosystems such as Solana, Ton, and Hyperliquid, and connect with traditional finance to provide products compliant with KYC and Islamic Finance. This will help Pendle expand into new markets, attract institutional investors, solidify its leadership position in the DeFi space, and increase TVL.

Of particular note in Citadels, Pendle plans to develop its PT into a reliable fixed-income investment product to attract traditional financial giants, meet the significant demand of virtual currency and traditional financial institutions for long-term fixed-income products. Pendle will also have the opportunity to further collaborate with traditional financial institutions to bring deeper expansion to Citadels, while the development of PT will also boost the organic growth of Pendle's yield trading pool, providing greater support to the crypto industry.

On March 31, Pendle announced its collaboration with Fasanara Digital, a well-known quantitative hedge fund specializing in alternative credit. As a renowned alternative asset management company, Fasanara Capital's digital asset arm, Fasanara Digital, has profound financial and technological strength in the crypto industry. This partnership, undoubtedly, is a manifestation of Pendle's continuous expansion into the traditional finance industry.

As an industry leader, Fasanara Capital certainly has high demands for asset security, funding rates, and flexibility. Pendle enables Fasanara to choose structured products from a diversified asset base including BTC, ETH, and stablecoin derivatives, undoubtedly showing high recognition of Pendle's security and liquidity. Through Citadels, Pendle acts as an institutional fixed-income infrastructure, similar to how banks serve as credit infrastructure.

Smart Money and Smart Investment: Reassessing Pendle's Long-Term Value

As the market shifts from frenzy to sobriety, "smart money" begins to replace speculative funds as the mainstream player. The term "smart money" not only refers to those with additional information but also to those with professional research teams, rich experience, and a focus on long-term value. They often strategically position themselves when the market cools down, seeking high-quality projects that truly address core needs, have sustainable cash flows, or possess technological moats. Pendle's attractiveness in this regard becomes increasingly apparent:

1. Real Yield Scenarios: The market demand for fixed income and hedging strategies has been repeatedly validated in traditional finance. Therefore, once Pendle smoothly transplants these patterns into the DeFi world, the probability of attracting various long-term funds is high.

2. Technological and Regulatory Extensions: Through the Citadels initiative, Pendle is no longer confined to the crypto sphere but actively engages with emerging markets such as TradFi and Islamic finance, expanding to a broader range of funding channels.

3. Controllable Risk, Stable Returns: Tools like Boros provide a robust "hedge" for the highly volatile perpetual contract market, allowing institutions and professional traders to more flexibly allocate and manage funding rate risks.

During market downturns, as "dumb money" gradually retreats, "smart money" becomes mainstream. Pendle's interest rate derivatives and fixed income products act like a magnet, attracting funds seeking stable, efficient, and secure returns. Unlike projects that rely solely on concepts and packaging, Pendle provides its users, LPs, and institutional investors with practical financial tools. This down-to-earth positioning also gives it a substantial long-term growth trajectory, gaining more and more favor from funds.

A Rebirth of Value

The cryptocurrency industry, post-bubble burst, is reexamining "what truly meaningful innovation is and what sustainable value can be." The essence of DeFi is not a DeGen dual pool with over ten thousand APY, but financial innovation that can be aligned with the real world. Therefore, amidst the noisy market and numerous competing projects, only protocols that can genuinely provide practical functionality and address real pain points will survive in the long term. On this path, Pendle is not just a DeFi protocol but has also set an example for the entire industry through its experiences, serving as a bridge that spans from traditional finance to the emerging blockchain ecosystem, bringing a comprehensive upgrade to fixed income and interest rate derivatives.

As the market gradually returns to calm, it is a good opportunity for those who are committed to long-term strategies to rethink and seize opportunities. Through intricate "interest rate puzzles," Citadels focusing on compliance and diverse markets, and the high capital efficiency of Boros, Pendle sketches a broad picture encompassing both DeFi and TradFi.

Where there's yield, there's Pendle.

You may also like

Gold vs Bitcoin: Which Is the Real Safe Haven in 2026's Turbulent Markets?

Gold vs Bitcoin in 2026: Which asset actually protects wealth during market stress? A closer look at safe havens in times of crisis.

Other than disavowing oneself, what is Vitalik thinking about

Canadian Regulator Establishes Stricter Crypto Custody Standards to Mitigate Losses

Key Takeaways: The Canadian Investment Regulatory Organization (CIRO) introduces a Digital Asset Custody Framework aimed at enhancing the…

Bitmine Chair Tom Lee Brushes Off ETH Treasury Losses, Questions ETF Scrutiny

Key Takeaways Bitmine chairman Tom Lee defends the company’s Ethereum treasury strategy amid market downturns, citing long-term planning.…

Aave Goes All-In on DeFi, Shuts Down Avara Brand and Family Wallet

Key Takeaways Aave is consolidating under Aave Labs, phasing out the Avara brand and Family wallet. The shift…

American ‘Big Short’ Investor Michael Burry Warns of $1B Precious Metals Catastrophe if Bitcoin Keeps Slipping

Key Takeaways Michael Burry predicts a significant sell-off in precious metals if Bitcoin prices continue to decline. Bitcoin’s…

Best Crypto to Buy Now February 3 – XRP, PEPE, Dogecoin

Key Takeaways The crypto market recently saw a significant decline, considerably affecting Bitcoin and revealing the ecosystem’s dependency…

We Hacked Elon’s Grok AI to Predict the Price of XRP, Solana, and Bitcoin By the End of 2026

Key Takeaways Grok AI predicts significant bullish trends for XRP, Solana, and Bitcoin by 2027. XRP is projected…

Solana Price Prediction: RSI Screams Oversold at $100 – Is the Market About to Snap Back Hard?

Key Takeaways Solana’s RSI indicates an oversold condition, signaling a potential upward swing from the $100 level. Historical…

Vitalik Buterin Engages as Developers Add Frame Transactions to Ethereum’s Upcoming Upgrade

Key Takeaways: Ethereum developers are contemplating Frame Transactions as a headline feature in the upcoming Hegota upgrade, with…

Crypto Price Predictions for 3 February – XRP, Solana, and Pi Coin

Key Takeaways February is historically a strong month for Bitcoin, suggesting potential recovery for altcoins following a challenging…

Cathie Wood’s Ark Invest Ventures Into Crypto Dip With Strategic Bitmine and Circle Acquisitions

Key Takeaways Ark Invest’s Strategic Purchases: Cathie Wood’s Ark Invest capitalizes on a crypto slump by investing in…

Nevada Moves to Block Coinbase Prediction Markets Post-Polymarket Ban

Key Takeaways: Nevada regulators have lodged a civil complaint against Coinbase to halt its prediction markets. The state’s…

Asia Market Open: Bitcoin Decreases 3% To $76K As Asian Markets Follow U.S. Tech Selloff

Key Takeaways Recent market shifts saw Bitcoin decrease by 3% to $76,000 amid a broader tech sector decline…

Untitled

I’m sorry, but I’m unable to rewrite the article without the original text or content to reference. Could…

Moscow Exchange Plans Solana, Ripple, and Tron Futures as Crypto Index Suite Expands

Key Takeaways Moscow Exchange is set to broaden its cryptocurrency offerings by introducing futures for Solana, Ripple, and…

Bitcoin Price Prediction: Binance Acquires $100M BTC – Preparing $1 Billion Further Investment

Key Takeaways Binance is undertaking a $1 billion accumulation strategy, starting with a $100 million Bitcoin purchase. Their…

XRP Price Prediction: Ripple Backs the Tokenization of $280M in Diamonds on XRPL

Key Takeaways Ripple plans to enhance diamond investment accessibility by tokenizing $280 million worth of diamonds on the…

Gold vs Bitcoin: Which Is the Real Safe Haven in 2026's Turbulent Markets?

Gold vs Bitcoin in 2026: Which asset actually protects wealth during market stress? A closer look at safe havens in times of crisis.

Other than disavowing oneself, what is Vitalik thinking about

Canadian Regulator Establishes Stricter Crypto Custody Standards to Mitigate Losses

Key Takeaways: The Canadian Investment Regulatory Organization (CIRO) introduces a Digital Asset Custody Framework aimed at enhancing the…

Bitmine Chair Tom Lee Brushes Off ETH Treasury Losses, Questions ETF Scrutiny

Key Takeaways Bitmine chairman Tom Lee defends the company’s Ethereum treasury strategy amid market downturns, citing long-term planning.…

Aave Goes All-In on DeFi, Shuts Down Avara Brand and Family Wallet

Key Takeaways Aave is consolidating under Aave Labs, phasing out the Avara brand and Family wallet. The shift…

American ‘Big Short’ Investor Michael Burry Warns of $1B Precious Metals Catastrophe if Bitcoin Keeps Slipping

Key Takeaways Michael Burry predicts a significant sell-off in precious metals if Bitcoin prices continue to decline. Bitcoin’s…

Earn

Earn