Sui Network's Phoenix Moment: Technical Resilience and Ecosystem Recovery After the Security Crisis

On May 22, 2025, the Sui Network faced a significant test when Cetus, a flagship AMM protocol in its ecosystem, suffered an exploit resulting in over $200 million in losses. Yet less than two weeks later, Sui shows remarkable recovery signs, with its token stabilizing around $3.25 and community sentiment strongly bullish at 84%.

This analysis examines the Cetus exploit, Sui's response mechanisms, and evaluates whether Sui still possesses the foundation for long-term growth despite this setback.

Understanding the Cetus Attack

What Happened?

The attack leveraged a mathematical vulnerability in Cetus's contract implementation - specifically an arithmetic overflow issue involving masking and bit shift operations. The attacker initiated a flash loan of 10 billion haSUI tokens, manipulated prices within an extremely narrow range, and exploited the vulnerability to extract approximately:

12.9 million SUI (~$54 million)

60 million USDC

4.9 million Haedal Staked SUI (~$19.5 million)

Other ecosystem tokens worth ~$66.5 million

Not a Fundamental Sui or Move Vulnerability

Security firms confirmed that the vulnerability existed specifically in Cetus's implementation of mathematical functions, not in Sui's underlying architecture or the Move programming language. The bug was:

Implementation-specific: Located in Cetus's math library, which wasn't included in previous audits

Easily fixable: Required only a two-line code change to implement proper boundary checking

Highly concealed: Remained undetected for nearly two years, as it required specific conditions to trigger

Sui's Emergency Response

Sui's handling of this crisis demonstrated the network's ability to rapidly coordinate a defensive response:

Address freezing: Validators synchronized the attacker's addresses to a deny list, freezing over $160 million in stolen funds

Recovery strategy: The Sui Foundation worked directly with Cetus on a compensation plan for affected users

Security reinforcement: A $10 million security audit fund was announced to strengthen ecosystem projects

This response highlighted the TransactionDenyConfig mechanism, which enables validators to block transactions involving flagged addresses during critical security events.

Technical Advantages That Protected the Ecosystem

Move Language Security Architecture

Sui's ability to contain damage stems from its Move programming language, which implements a resource-oriented programming model:

Ownership clarity: Assets are "resources" with single, explicit owners, unlike account-based models

Natural permission isolation: Resources can only be accessed by owners or through explicit authorization

Resource lifecycle tracking: Move's linear type system prevents common vulnerabilities like reentrancy attacks

The Cetus exploit occurred in an area using manual checks rather than relying on Move's native safety features, highlighting how deviations from the language's safety patterns can introduce vulnerabilities.

Efficient Consensus Structure

Sui implements a Delegated Proof of Stake (DPoS) mechanism with approximately 106 active validators. While critics point to this as evidence of centralization compared to Ethereum's validators, this structure enabled rapid coordination during the crisis without resorting to controversial measures like hard forks.

Ecosystem Recovery Signs

Despite the incident's impact, Sui's ecosystem shows remarkable resilience:

Market Performance

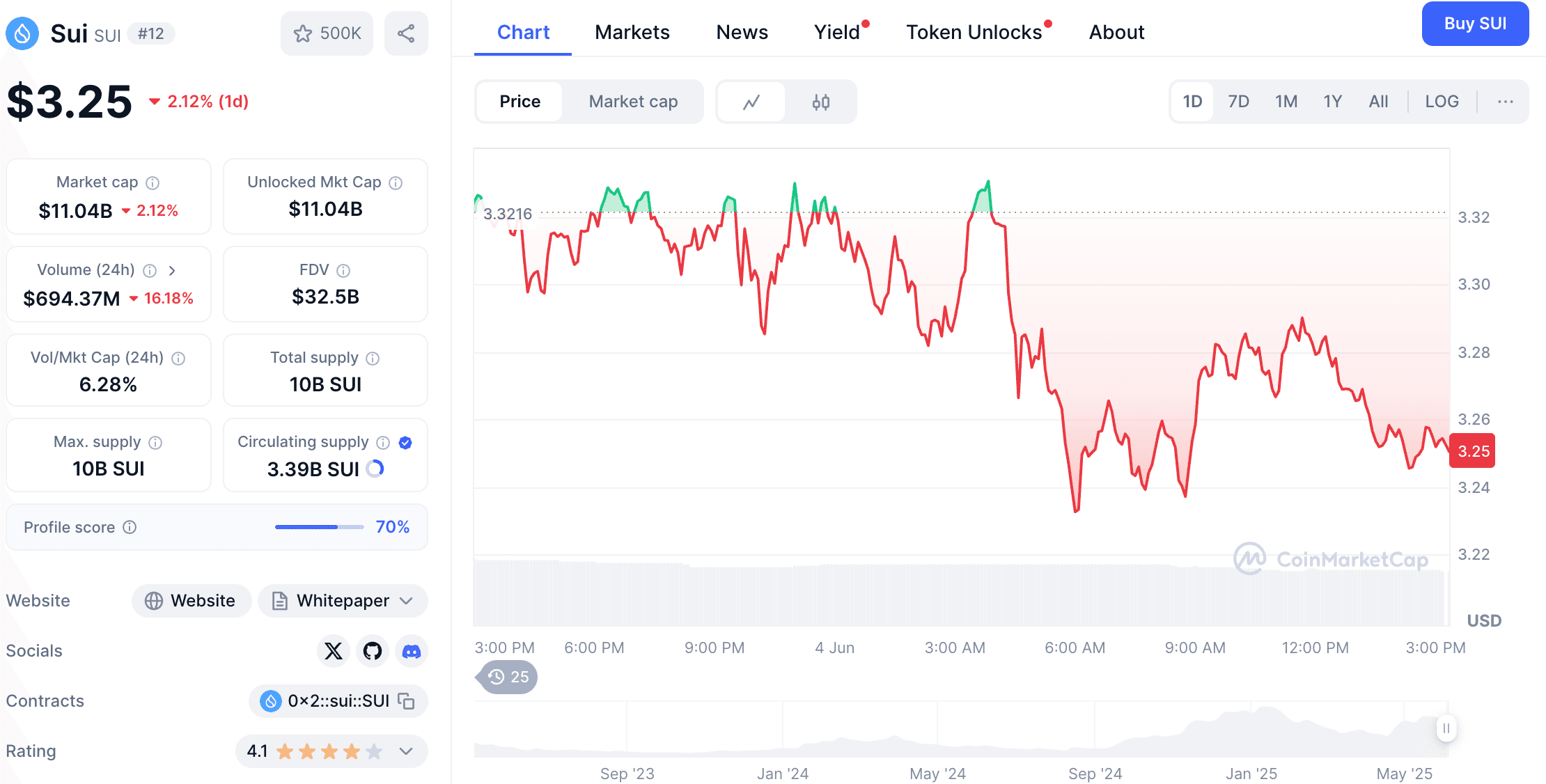

Current data shows Sui trading at $3.25, with a market cap of $11.04 billion and 84% bullish sentiment according to CoinMarketCap.

DeFi Ecosystem Strength

TVL Resilience: Total Value Locked remains around $1.6 billion, maintaining Sui's position as the 8th largest blockchain by TVL globally according to DeFiLlama

Stablecoin Growth: Circulation has surpassed $1 billion

Transaction Activity: Sui ranks 5th globally and 3rd among non-EVM networks

Key Projects Driving Recovery

| Project | Category | Key Features | TVL/Volume |

|---|---|---|---|

| DeFi Infrastructure | Multi-asset lending, leveraged vaults | $400M+ TVL | |

| Stablecoin | $BUCK stablecoin with multi-asset collateral | $110M+ TVL | |

| Trading | Perpetual contracts with 20x leverage | $50B+ volume | |

| Liquid Staking | Native SUI liquid staking | Rank 4 by TVL |

These diverse projects have provided stability and continued functionality even as Cetus recovered from the incident.

Security Improvements Following the Crisis

The Cetus incident catalyzed significant security enhancements:

Enhanced audit standards: New requirements for mathematical auditing, boundary verification, and formal verification

Real-time monitoring systems: Collaboration on tools to detect unusual price movements and suspicious flash loan activity

Collaborative security framework: Coordinated emergency communications between projects, validators, and the Foundation

How Sui Compares to Other Layer-1s After Security Incidents

When evaluating security response and recovery against other major blockchains, Sui showed strength:

| Network | Notable Security Incident | Response Time | Fund Recovery |

|---|---|---|---|

| Sui | Cetus Exploit (2025) | Hours | ~80% (projected) |

| Solana | Mango Markets Hack (2022) | Days | ~90% |

| Ethereum | The DAO Hack (2016) | Weeks | ~100% via hard fork |

Sui's response combined the speed of more centralized networks with a more measured approach than Ethereum's contentious hard fork.

Investment Perspective: Risks and Opportunities

Positive Indicators

Technical foundation remains sound: The incident highlighted implementation issues, not protocol weaknesses

Ecosystem diversity: Multiple strong projects across different sectors provide stability

Institutional support: Major exchanges including WEEX continue supporting Sui ecosystem projects

Risk Considerations

Market perception: Some participants may conflate project-level vulnerabilities with network risks

DeFi maturity: Sui's DeFi ecosystem, while growing rapidly, is still younger than Ethereum's

Competitive pressure: Established networks continue aggressive scaling efforts

Conclusion: Why Sui Maintains Long-Term Growth Potential

The Cetus exploit represents a significant but contained challenge in Sui's journey. Rather than revealing fundamental flaws, the incident demonstrated several strengths:

Technical robustness: The Move language continues to provide strong security guarantees, with the vulnerability stemming from implementation-specific issues

Governance effectiveness: Sui's validator structure enabled rapid coordination during crisis

Ecosystem diversity: Multiple strong projects ensured the incident didn't destabilize the entire ecosystem

Recovery mechanisms: Multi-layered approach combining validator-level security features, Foundation support, and compensation plans

Despite being less than two years since mainnet launch, Sui has established itself as a top-10 blockchain by TVL and a top-5 network by transaction activity. Its response to the Cetus incident demonstrates that in blockchain ecosystems, periods of stress often separate truly resilient systems from merely successful ones.

For those seeking a blockchain with technical advantages, governance responsiveness, and ecosystem vitality, Sui remains a compelling option in the competitive layer-1 landscape.

Disclaimer: This analysis is for informational purposes only and should not be considered investment advice. Always conduct your own research before making investment decisions.

You may also like

ARK Invest: Stablecoins are Constructing the Next-Generation Monetary System

President Trump Asserts Imminent Passing of Crypto Market Structure Bill

Key Takeaways Presidential Confirmation: President Trump states the major crypto market structure bill is on the verge of…

Germany Central Bank Head Advocates for European Crypto Stablecoins Under EU MiCA Framework

Key Takeaways Joachim Nagel, head of the Germany Bundesbank, is advocating for the adoption of euro-based crypto stablecoins…

Polygon Surpasses Ethereum in Daily Fees as Polymarket Bets Rocket

Key Takeaways Polygon has outpaced Ethereum in daily transaction fees, a historic shift driven by activity on Polymarket.…

Bitcoin Price Prediction: BTC Short Squeeze Alert – Is a Significant Rebound on the Horizon?

Key Takeaways Recent data indicates Bitcoin shorts have escalated to unprecedented levels reminiscent of a major market low…

Google’s Gemini AI Predicts the Price of XRP, Solana, and Bitcoin by the End of 2026

Key Takeaways XRP’s Potential: Google’s Gemini AI forecasts XRP could reach $10 by 2026, leveraging Ripple’s payment solutions…

Top Analyst Warns Bitcoin Price Could Plummet to $10,000 Amid Deepening Bear Market

Key Takeaways Bitcoin’s value could potentially drop to $10,000 as part of an imploding bubble, suggests a renowned…

Best Crypto to Buy Now February 10 – XRP, Solana, Dogecoin

Key Takeaways XRP is poised for long-term growth with its recent strategic expansions in institutional-grade payments and tokenization.…

Kyle Samani Criticizes Hyperliquid in Explosive Post-Departure Market Commentary

Key Takeaways: Kyle Samani, after leaving Multicoin Capital, criticized Hyperliquid, a decentralized exchange, labeling it as a systemic…

XRP Price Prediction: A 50M Token Sell-Off Just Shook the Market — Is More Loss Imminent?

Key Takeaways Over 50 million XRP hit the market within a span of less than 12 hours, leading…

Strategy Plans to Equitize Convertible Debt Over 3–6 Years: What It Means for BTC

Key Takeaways Strategy, led by Michael Saylor, is equitizing $6 billion in convertible debt as a long-term strategy…

BlockFills Freezes Withdrawals as Bitcoin Declines, Heightening Counterparty Risk Concerns

Key Takeaways BlockFills, an institutional trading firm, has stopped client withdrawals amid rising market volatility and Bitcoin price…

Leading AI Claude Predicts the Price of XRP, Cardano, and Ethereum by the End of 2026

Key Takeaways Claude AI projects substantial growth for XRP, Cardano, and Ethereum by the end of 2026, with…

Crypto Price Forecast for 16 February – XRP, Ethereum, Cardano

Key Takeaways Technical trends and recent developments suggest potential growth for XRP, Ethereum, and Cardano. XRP is targeting…

Bitcoin Price Prediction: Alarming New Research Warns Millions in BTC at Risk of ‘Quantum Freeze’ – Are You Protected?

Key Takeaways Recent market movements have sparked concerns over a potential bear market for Bitcoin, marked by significant…

XRP Price Forecast: Can XRP Truly Surpass Bitcoin and Ethereum? Analyst Argues the Contest Has Already Begun

Key Takeaways XRP has maintained significant support around the $1.40 level despite a 12% decline over the past…

Best Crypto to Purchase Now February 6 – XRP, Solana, Bitcoin

Key Takeaways XRP’s Strength: Ripple’s focus on challenging traditional systems like SWIFT is driving XRP towards a potential…

South Korea Intensifies Crypto Market Investigations Following Bithumb Incident

Key Takeaways A $44 billion mishap at Bithumb has prompted South Korean authorities to step up their scrutiny…

ARK Invest: Stablecoins are Constructing the Next-Generation Monetary System

President Trump Asserts Imminent Passing of Crypto Market Structure Bill

Key Takeaways Presidential Confirmation: President Trump states the major crypto market structure bill is on the verge of…

Germany Central Bank Head Advocates for European Crypto Stablecoins Under EU MiCA Framework

Key Takeaways Joachim Nagel, head of the Germany Bundesbank, is advocating for the adoption of euro-based crypto stablecoins…

Polygon Surpasses Ethereum in Daily Fees as Polymarket Bets Rocket

Key Takeaways Polygon has outpaced Ethereum in daily transaction fees, a historic shift driven by activity on Polymarket.…

Bitcoin Price Prediction: BTC Short Squeeze Alert – Is a Significant Rebound on the Horizon?

Key Takeaways Recent data indicates Bitcoin shorts have escalated to unprecedented levels reminiscent of a major market low…

Google’s Gemini AI Predicts the Price of XRP, Solana, and Bitcoin by the End of 2026

Key Takeaways XRP’s Potential: Google’s Gemini AI forecasts XRP could reach $10 by 2026, leveraging Ripple’s payment solutions…