South Korean Crypto KOLs Drive 1,200% $USELESS Rally: How a "Worthless" Token Hit $96M Market Cap

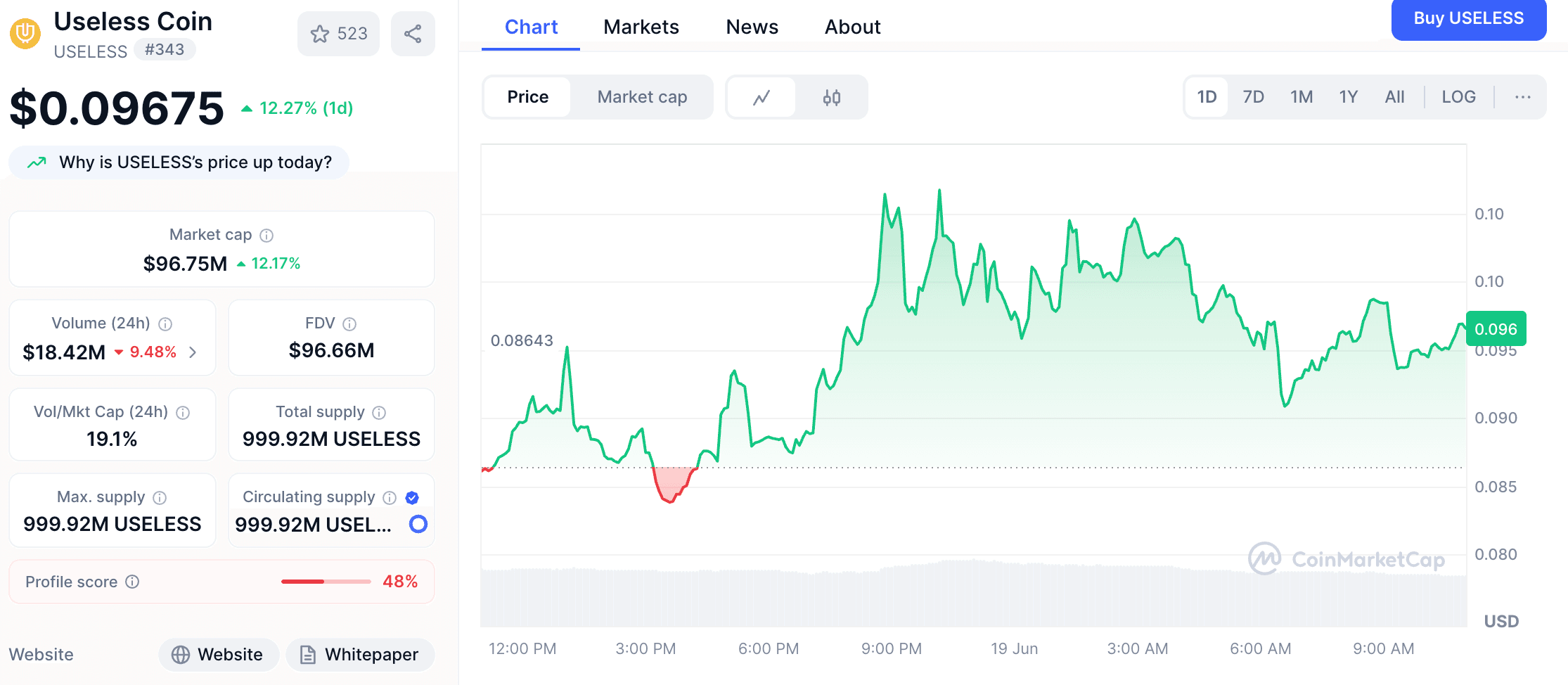

In the ever-evolving cryptocurrency landscape, South Korea's influential role in the altcoin market continues to make waves. The latest example is the remarkable rise of $USELESS, a memecoin experiencing a 12.15% daily surge that's pushed its market cap to nearly $100 million—despite or perhaps because of its transparently ironic name.

South Korean Influence Drives $USELESS Momentum

South Korea has long been known for its outsized impact on cryptocurrency markets, from last year's XRP frenzy that saw 400% price increases to the current fascination with a token that literally brands itself as worthless.

According to Bradley Park, a Seoul-based analyst at DNTV Research who spoke with CoinDesk, the $USELESS phenomenon is closely tied to Korean cryptocurrency key opinion leaders (KOLs).

At the center of this movement is Yeomyung, a prominent Korean KOL and liquidity provider. After investing early in $USELESS and holding through a 50% drawdown, he now boasts significant paper gains and has become the token's largest holder with a 2.8% stake.

"I now hold 2.8% of $USELESS, officially surpassing @theunipcs to become the largest holder. Yet I still won't sell. The era of BONK and USELESS is coming. $pump has always been 'useless'," Yeomyung (@duaud9912) posted on Twitter.

Park explained to CoinDesk: "He made enormous profits during the Trump coin hype, and with $USELESS, he's profiting from providing early liquidity and now just holding and waiting. They're all waiting for centralized exchange listings, because without that, there's no real exit."

This steadfast conviction has inspired copycat trading behavior among retail investors throughout South Korea. Even wallets associated with insiders from Solana's Jupiter platform (JUP) appear to be holding $USELESS.

From "Exit Liquidity" to Market Makers

The $USELESS phenomenon reflects a broader evolution in Korean market behavior.

"I truly believe Korean users are no longer just 'exit liquidity' in this market," Park noted. "They're starting to understand the market and gradually growing into genuine global players."

Another key figure in the $USELESS story is "Bonk Guy," an early promoter of BONK who resurfaced to enthusiastically promote $USELESS on Twitter as prices rebounded. However, some Korean traders, including Park, question his sincerity.

"Bonk Guy was the first to promote LetsBONK," Park said. "But after the price crashed, he went quiet. Now that $USELESS is rebounding, he's suddenly showing interest again."

The rise of Hyperliquid, Kaia, and now Solana-based memecoins like $USELESS indicates that South Korea has evolved beyond being a secondary market.

The Nihilistic Appeal of $USELESS

Unlike XRP's rise, which depended on U.S. regulatory clarity and narratives about deregulation under Trump, the $USELESS boom reflects the market's current attention span and exhaustion.

With no roadmap, no practical utility, and no pretense of building toward a greater vision, $USELESS represents a meme-ified disillusionment—a collective dismissal of traditional cryptocurrency promises and an ironic bet on "nothingness." Paradoxically, this bet seems more honest than many tokens claiming to change the world.

Trump Backs GENIUS Act

In related news, President Trump voiced support for the GENIUS Act on Tuesday via Truth Social. Having already passed the Senate with bipartisan support, Trump called the bill a crucial step in advancing American leadership in digital assets.

Trump urged the House to pass the legislation "at lightning speed" without modifications, demanding the bill reach his desk "with no delays, no attachments."

This stance demonstrates strong executive support for the "Guiding and Establishing National Innovation for U.S. Stablecoins Act," which introduces reserve and compliance requirements for USD-backed stablecoin issuers and represents the first major cryptocurrency legislation to pass the Senate.

Coinbase Launches Merchant Payment Platform

Coinbase (COIN) released Coinbase Payments on Wednesday—a new merchant payment solution built on its Ethereum Layer-2 network, Base.

According to CoinDesk, the platform is designed for global e-commerce platforms like Shopify, enabling 24/7 USDC stablecoin payments without merchants needing blockchain expertise. Features include gas-free stablecoin checkout, an e-commerce API engine, and an on-chain payment protocol.

Coinbase states the system aims to replicate traditional payment rails while reducing costs and offering around-the-clock settlement. This move positions Coinbase to compete with fintech companies like Stripe and PayPal in modernizing payments with blockchain infrastructure.

The release also deepens Coinbase's partnership with USDC issuer Circle (CRCL). Following the announcement, Circle's stock rose 25%, while Coinbase shares increased by 16%. Coinbase noted that stablecoins processed $30 trillion in transactions last year—triple the previous year—and is betting that programmable, dollar-pegged payments will continue disrupting the global financial system.

Market Dynamics

Despite escalating tensions between Israel and Iran, Bitcoin showed resilience with a V-shaped recovery, climbing back above $105,000. Strong ETF inflows and key support at $103,650 highlight institutional confidence amid market volatility.

Ethereum rose 4%, holding steady above $2,500. Record staking volumes and continued fund accumulation demonstrate strengthening investor confidence despite geopolitical tensions.

As traditional markets show mixed results, with gold slightly down and indexes responding cautiously to Fed policy statements, the cryptocurrency market—particularly in South Korea—continues to forge its own path with phenomena like $USELESS capturing both attention and capital.

You may also like

President Trump Asserts Imminent Passing of Crypto Market Structure Bill

Key Takeaways Presidential Confirmation: President Trump states the major crypto market structure bill is on the verge of…

Germany Central Bank Head Advocates for European Crypto Stablecoins Under EU MiCA Framework

Key Takeaways Joachim Nagel, head of the Germany Bundesbank, is advocating for the adoption of euro-based crypto stablecoins…

Polygon Surpasses Ethereum in Daily Fees as Polymarket Bets Rocket

Key Takeaways Polygon has outpaced Ethereum in daily transaction fees, a historic shift driven by activity on Polymarket.…

Bitcoin Price Prediction: BTC Short Squeeze Alert – Is a Significant Rebound on the Horizon?

Key Takeaways Recent data indicates Bitcoin shorts have escalated to unprecedented levels reminiscent of a major market low…

Google’s Gemini AI Predicts the Price of XRP, Solana, and Bitcoin by the End of 2026

Key Takeaways XRP’s Potential: Google’s Gemini AI forecasts XRP could reach $10 by 2026, leveraging Ripple’s payment solutions…

Top Analyst Warns Bitcoin Price Could Plummet to $10,000 Amid Deepening Bear Market

Key Takeaways Bitcoin’s value could potentially drop to $10,000 as part of an imploding bubble, suggests a renowned…

Best Crypto to Buy Now February 10 – XRP, Solana, Dogecoin

Key Takeaways XRP is poised for long-term growth with its recent strategic expansions in institutional-grade payments and tokenization.…

Kyle Samani Criticizes Hyperliquid in Explosive Post-Departure Market Commentary

Key Takeaways: Kyle Samani, after leaving Multicoin Capital, criticized Hyperliquid, a decentralized exchange, labeling it as a systemic…

XRP Price Prediction: A 50M Token Sell-Off Just Shook the Market — Is More Loss Imminent?

Key Takeaways Over 50 million XRP hit the market within a span of less than 12 hours, leading…

Strategy Plans to Equitize Convertible Debt Over 3–6 Years: What It Means for BTC

Key Takeaways Strategy, led by Michael Saylor, is equitizing $6 billion in convertible debt as a long-term strategy…

BlockFills Freezes Withdrawals as Bitcoin Declines, Heightening Counterparty Risk Concerns

Key Takeaways BlockFills, an institutional trading firm, has stopped client withdrawals amid rising market volatility and Bitcoin price…

Leading AI Claude Predicts the Price of XRP, Cardano, and Ethereum by the End of 2026

Key Takeaways Claude AI projects substantial growth for XRP, Cardano, and Ethereum by the end of 2026, with…

Crypto Price Forecast for 16 February – XRP, Ethereum, Cardano

Key Takeaways Technical trends and recent developments suggest potential growth for XRP, Ethereum, and Cardano. XRP is targeting…

Bitcoin Price Prediction: Alarming New Research Warns Millions in BTC at Risk of ‘Quantum Freeze’ – Are You Protected?

Key Takeaways Recent market movements have sparked concerns over a potential bear market for Bitcoin, marked by significant…

XRP Price Forecast: Can XRP Truly Surpass Bitcoin and Ethereum? Analyst Argues the Contest Has Already Begun

Key Takeaways XRP has maintained significant support around the $1.40 level despite a 12% decline over the past…

Best Crypto to Purchase Now February 6 – XRP, Solana, Bitcoin

Key Takeaways XRP’s Strength: Ripple’s focus on challenging traditional systems like SWIFT is driving XRP towards a potential…

South Korea Intensifies Crypto Market Investigations Following Bithumb Incident

Key Takeaways A $44 billion mishap at Bithumb has prompted South Korean authorities to step up their scrutiny…

BTC Traders Eye $50K as Possible Bottom: Key Metrics to Watch This Week

Key Takeaways Bitcoin’s price fluctuations lead traders to eye $50,000 as a critical bottom. Despite a recent rally…

President Trump Asserts Imminent Passing of Crypto Market Structure Bill

Key Takeaways Presidential Confirmation: President Trump states the major crypto market structure bill is on the verge of…

Germany Central Bank Head Advocates for European Crypto Stablecoins Under EU MiCA Framework

Key Takeaways Joachim Nagel, head of the Germany Bundesbank, is advocating for the adoption of euro-based crypto stablecoins…

Polygon Surpasses Ethereum in Daily Fees as Polymarket Bets Rocket

Key Takeaways Polygon has outpaced Ethereum in daily transaction fees, a historic shift driven by activity on Polymarket.…

Bitcoin Price Prediction: BTC Short Squeeze Alert – Is a Significant Rebound on the Horizon?

Key Takeaways Recent data indicates Bitcoin shorts have escalated to unprecedented levels reminiscent of a major market low…

Google’s Gemini AI Predicts the Price of XRP, Solana, and Bitcoin by the End of 2026

Key Takeaways XRP’s Potential: Google’s Gemini AI forecasts XRP could reach $10 by 2026, leveraging Ripple’s payment solutions…

Top Analyst Warns Bitcoin Price Could Plummet to $10,000 Amid Deepening Bear Market

Key Takeaways Bitcoin’s value could potentially drop to $10,000 as part of an imploding bubble, suggests a renowned…